During the last week of February, U.S. equity markets experienced their biggest one-week decline since 2008, with the S&P 500® Index falling nearly 13%. The sell-off was sparked by growing fears about the coronavirus, officially known as COVID-19, and its potential to turn into a global pandemic.

Markets have remained highly volatile in March as the virus has continued its spread through Asia, Europe and the United States. As of this writing, there are over 105,000 confirmed cases of the virus worldwide — over 500 of which are in the U.S. — and more than 3,500 deaths. Moreover, oil prices cratered over this past weekend as Saudi Arabia launched a surprise price war against Russia after the two nations failed to agree on production cuts aimed at helping a weakening global oil market.

It can often appear that stock markets are reacting to minute-by-minute headlines. Given that stocks had a surprisingly powerful rally in 2019 and we are now in the 11th year of the current bull market — several years longer than the historical average — financial market volatility should be expected. Furthermore, the stock market has historically experienced an average 10% decline during presidential election years. So, the recent downturn is not out of the ordinary. However, the recent plunge in the 10-year Treasury bond yield to a record low of under 0.50% is unusual and is a potentially ominous sign for the economy. Despite the Federal Reserve’s inter-meeting Fed Funds rate cut of 0.50% last week, investor fear remains high and markets continue to trade lower.

We cannot be sure of the near-term ramifications of these events on the stock market, and whether we will experience a quick bounce back (as we have seen during other corrections since 2008) or a longer-term downturn. Two things we will be watching closely are corporate earnings growth and global economic activity, as we believe these are the most important factors in determining how stocks trade from this point forward. If the coronavirus, oil weakness or some other unforeseen catalyst puts significant downward pressure on corporate profits, there are likely to be continued selloffs in the market. What began as a supply shock driven by Chinese factory closings has the potential to evolve into a demand shock if consumers and businesses continue to curb activity (e.g., drastically reducing travel, cancelling events, self-quarantining, etc.) and spending. We believe the widespread fear currently permeating markets has increased the potential for a recession in the next 12 months.

Basics principles for financial planning

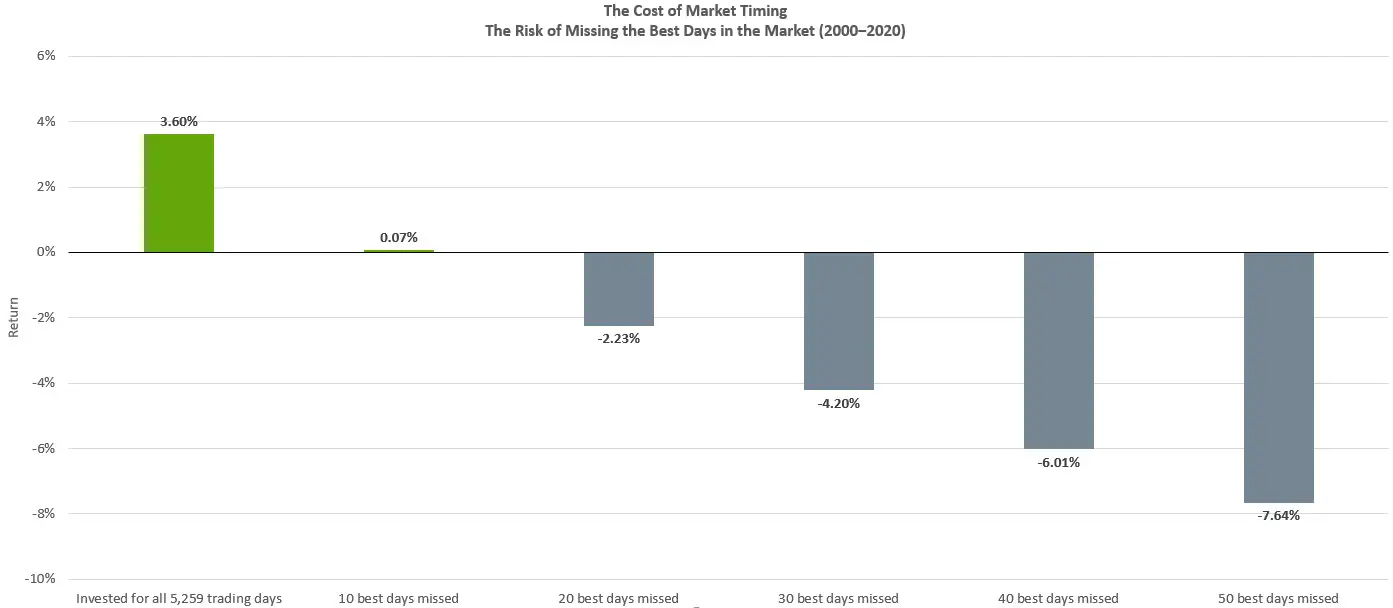

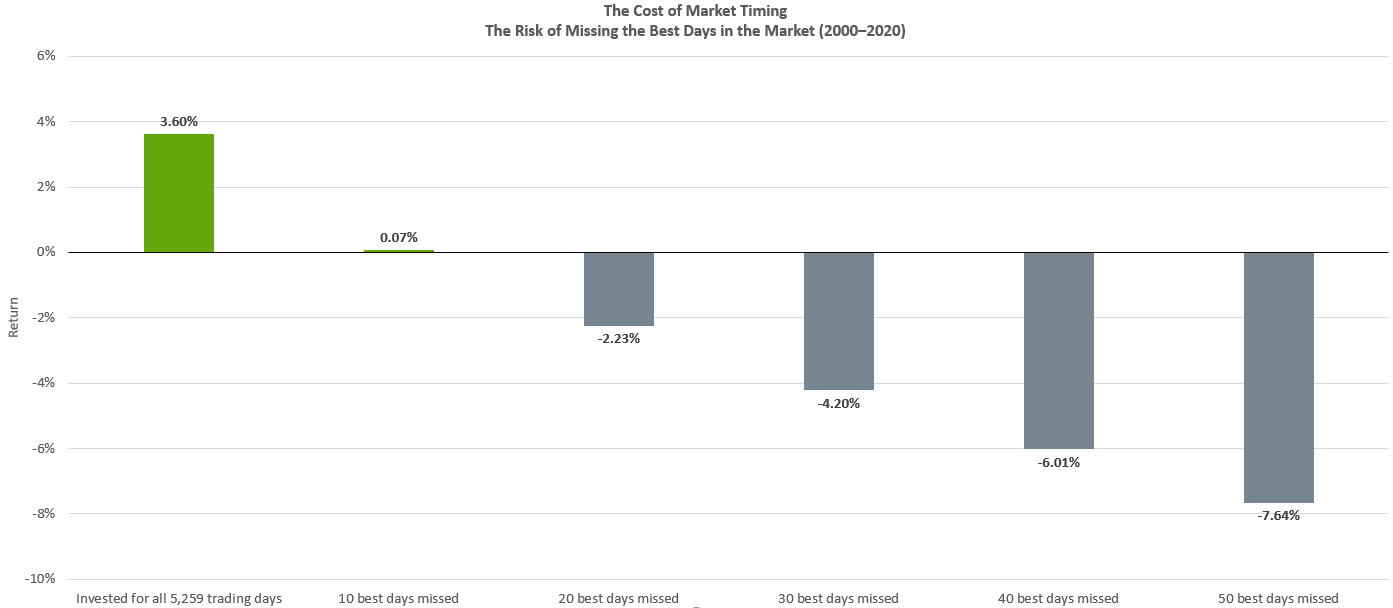

Market sell-offs can be dangerous for long-term investors because they can trigger fear-driven “market timing” impulses to sell out of positions. History has shown there’s a real cost to trying to time the market. As illustrated in the chart below, missing the best 10 days in the market dating back to 2000 would essentially eliminate an investor’s gains.

GuideStone encourages investors to remember these four basic principles:

Always Focus on Long-Term Objectives, Not Emotions — Especially for retirement participants, these assets are intended to serve needs for a long period of time. Make sure objectives and actions are consistent with the time horizon.

Avoid Making Impulsive Decisions — Making changes based on short-term market moves has a higher degree of failure, as it promotes buying high and selling low. The performance of an account moving forward will be determined based on results of the financial markets in the future, not the past. Investors cannot sell yesterday’s losses or buy yesterday’s gains.

Don’t Count Losses (or Gains) — Consistent contributions to an investment account or retirement plan afford investors a systematic way of taking advantage of investment opportunities as markets ebb and flow.

Maintain Realistic Expectations About Market Behavior — Financial markets in the short term tend to fluctuate in response to social, political and economic events. However, historically, the markets stabilize and return to profitability over the long term, focusing on the underlying fundamentals.

Volatility can be unnerving, but markets have historically rewarded a long-term focus and a diversified investment approach. Investors concerned by the market’s recent moves should look at their portfolios and ensure they are appropriately diversified. Active investors who believe they have too much equity exposure relative to their risk tolerance and long-term objectives should consider whether it makes sense to explore less-volatile asset classes — however, this should be done in an attempt to better align asset allocation with investor goals, not in an attempt to time the market. During times of uncertainty, it is important for investors to remain committed to their long-term investing strategy.